Pinellas/Clearwater Beach Real Estate Report – June 2016

Pinellas/Clearwater Beach Real Estate Report – June 2016

The Absorption Rate for the Single Family real estate market has been steadily rising this year, and is at an all-time high, not just for 2016, but dating back to at least January 2012. The Absorption Rate is the rate at which homes are selling in a given time frame. Mortgage interest rates dropped after the Brexit vote and continue to remain low, which could push new buyers and investors into the market. Find your piece of paradise on Clearwater Beach.

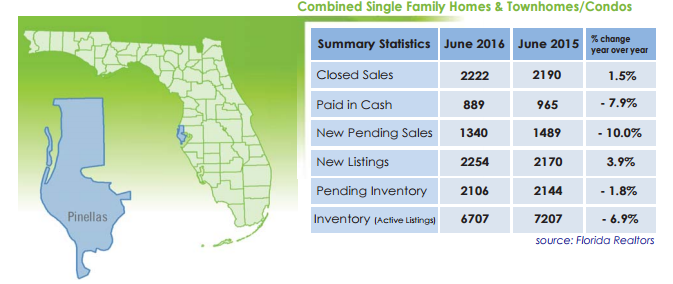

The number of Closed Sales for Single Family and Townhome/Condo combined for June 2016 was 2,222, up 1.5% from 2,190 in June 2015. Year-over-year, closed sales for the Single Family segment were up at 0.3%, and Closed Sales for the Townhome/Condo segment were up 3.6%. New Listings for Single Family and Townhome/Condo combined were up 3.9% for June 2016 over June 2015, at 2,254 versus 2,170 last year.

Median Time to Contract for Single Family was down 9.7% year-over-year, going from 31 days in June 2015 to 28 days in June 2016. Median Time to Sale for Single Family was just 72 days in June 2015, down from 76 days in June 2016 (down 5.3%). For Townhome/Condo Median Time to Sale was 86 days this June, versus 93 days in June 2015, a -7.5% change year-over-year.

- Median Sale Price for Single Family was $220,000 this June, versus $185,000 last June, a huge increase of 18.9%.

- Median Sale Price for the Townhome/Condo segment was also way up from last June at 16.7%, at $140,000 for June 2016 versus $120,000 for June 2015.

Dollar Volume for Single Family was $419.8 million in June 2016, up 18.3% from $354.9 million in June 2015.

Dollar Volume for Townhome/Condo was $165.0 million in June 2016, up 14.9% from $143.5 million in June 2015.

New Listings for Single Family for June 2016 were 1,493, up 5.2% from last June, when they were 1,419.

New Listings for Townhome/Condo for June 2016 were 761, up 1.3% from 751 in June 2015.

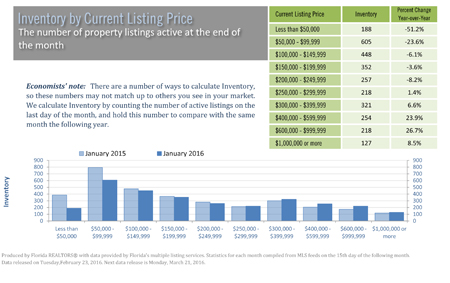

Months Supply of Inventory for Single Family continues to reflect the seller’s market, with inventory down 13.2% year-over-year, with a 3.3 month supply this June, as compared to a 3.8 month supply in June 2015. Months Supply of Inventory for Townhome/Condo was down 9.1% year-over-year, with 4.0 months in June 2016 compared to 4.4 months in June 2015. Active listings for June 2016 Single Family and Townhome/Condo combined were 6,707, down 6.9% from 7,207 in June 2015.

Pinellas Realtor® Association July 2016

" alt="" />

" alt="" /> Perhaps granite’s top competitor, engineered quartz offers the beauty of stone without the maintenance. It’s tougher than granite, and it’s highly resistant to scratching, cracking, staining and heat. Unlike granite, which offers the unique qualities of natural stone, engineered quartz is largely uniform; because it’s engineered, there’s no choice of one-of-a-kind slab. There are, however, a number of colors and designs available — from stark modern whites to options closely resembling marble. And, because engineered quartz is non-porous, it never has to be sealed like natural stone.

Perhaps granite’s top competitor, engineered quartz offers the beauty of stone without the maintenance. It’s tougher than granite, and it’s highly resistant to scratching, cracking, staining and heat. Unlike granite, which offers the unique qualities of natural stone, engineered quartz is largely uniform; because it’s engineered, there’s no choice of one-of-a-kind slab. There are, however, a number of colors and designs available — from stark modern whites to options closely resembling marble. And, because engineered quartz is non-porous, it never has to be sealed like natural stone. Soapstone is an attractive, natural quarried stone that ranges from light gray to green-black in color. While the material is soft and pliable, it’s also nonporous. Soapstone is also resistant to stains and acidic materials. The downside to soapstone is that it is susceptible to scratches and deep indentations. Light gray soapstone will also weather and darken over time, occasionally developing a patina finish. The material comes in smaller slabs, so seams will be visible in soapstone countertops longer than seven feet.

Soapstone is an attractive, natural quarried stone that ranges from light gray to green-black in color. While the material is soft and pliable, it’s also nonporous. Soapstone is also resistant to stains and acidic materials. The downside to soapstone is that it is susceptible to scratches and deep indentations. Light gray soapstone will also weather and darken over time, occasionally developing a patina finish. The material comes in smaller slabs, so seams will be visible in soapstone countertops longer than seven feet. There’s a reason restaurants use stainless steel countertops in their kitchens. It’s heat-, rust- and stain-resistant; it’s easy to clean; and it won’t absorb or harbor even the toughest bacteria. The downside to stainless steel countertops is that they scratch easily — and they show it too. For this reason, it’s best to use a cutting board any time you’re prepping food on a stainless steel countertop. Also, it’s a good idea to choose a brushed stainless finish that will help conceal any marks. At first blush, you may think that stainless feels ultramodern or cold, but a balance of stainless steel and wood can create a warm, timeless and uber-functional kitchen.

There’s a reason restaurants use stainless steel countertops in their kitchens. It’s heat-, rust- and stain-resistant; it’s easy to clean; and it won’t absorb or harbor even the toughest bacteria. The downside to stainless steel countertops is that they scratch easily — and they show it too. For this reason, it’s best to use a cutting board any time you’re prepping food on a stainless steel countertop. Also, it’s a good idea to choose a brushed stainless finish that will help conceal any marks. At first blush, you may think that stainless feels ultramodern or cold, but a balance of stainless steel and wood can create a warm, timeless and uber-functional kitchen. Clearwater Beach Real Estate – Working with a Realtor® in a

Clearwater Beach Real Estate – Working with a Realtor® in a

In Florida, buyers closed on 18,159 single-family homes in January 2016, up 0.4 percent, but condo sales fell 5.4 percent to 7,658 units.

In Florida, buyers closed on 18,159 single-family homes in January 2016, up 0.4 percent, but condo sales fell 5.4 percent to 7,658 units. WASHINGTON – March 17, 2016 – Home prices are rising three to four times faster than wages, and credit conditions are loosening, say Lawrence Yun, chief economist for the National Association of Realtors®. Those conditions usually prompt housing analysts to start uttering the words “housing bubble,” but Yun discounts those warnings.

WASHINGTON – March 17, 2016 – Home prices are rising three to four times faster than wages, and credit conditions are loosening, say Lawrence Yun, chief economist for the National Association of Realtors®. Those conditions usually prompt housing analysts to start uttering the words “housing bubble,” but Yun discounts those warnings. Pinellas County Real Estate Report — January 2016 — One of the most impressive figures in the table below is found in the median sales price and average sales price categories.

Pinellas County Real Estate Report — January 2016 — One of the most impressive figures in the table below is found in the median sales price and average sales price categories.

Wall Street is hurting, and Main Street doesn’t care. It’s got burgers and cars to buy.

Wall Street is hurting, and Main Street doesn’t care. It’s got burgers and cars to buy.